While the attack on social welfare threatens hundreds of thousands in the UK with destitution, there has been virtually no public discussion about the role, cost and desirability of corporate welfare – the vast sums of taxpayers’ money given to corporations in the form of subsidies, tax write-offs and other incentive and support payments.

Support payments to companies are not necessarily unjustified per se, either on social or economic grounds. But there is an increasing suspicion that corporate welfare has become a ‘benefit’ that large corporations can negotiate as part of their search for competitive advantage. Among other things, it’s another way in which corporations can load the dice against small and medium-sized enterprises (SMEs) trying to compete with them in the same market.

This LA Times story shows how the big US banks are trying to remove the tax exemption enjoyed by credit unions, which have grown in popularity since the 2007 financial crash as customers seek alternatives to the discredited major financial institutions.

Of course, this story is about a comparatively small market sector enjoying a tax break. But it’s significant not only because it reveals how the big banks continue to see corporate welfare as an important part of their competitive strategy, but also because the story has appeared at all.

In Britain, the corporate welfare spend is not easy to quantify, reflecting the comparative secrecy of the relationship between state and big private institutions, and the balance of the ‘benefit scroungers’ debate, which is exclusively focused on the poor. However, academic studies suggest that UK corporate welfare payments, even in this age of austerity, could amount to as much as £254bn per year, if it follows the same pattern of corporate support found in the US (where ‘state provision’ for business accounts for around 47% of total government spending).

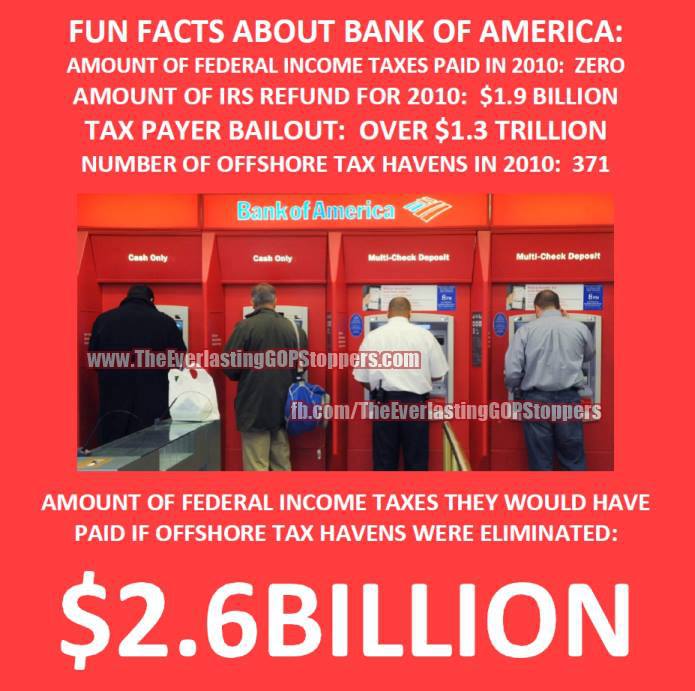

Such spending also has to be seen in the context of the cost of bailing out the banking sector as a result of the 2007 crash. The cost to the UK taxpayer was estimated in September 2012 to have reached £1.162tn. The net cost of bank bailouts in the US, however, was put at $3.3tn in March 2012, with bailout guarantees reaching a truly staggering $16.9tn.

Whether companies can assume it’s business as usual on the corporate welfare front is questionable. Special tax regimes for multinationals and other corporate welfare payments will only become more contentious and divisive as the cuts to social welfare bite. Indeed, US Uncut and UK Uncut are becoming increasingly active in organising direct actions against what they see as corporate tax avoiders.

As the anger over social welfare cuts rises, as it inevitably will, corporate welfare in all its forms could easily become the means by which a company’s social responsibility is measured. Which means that any effective strategy to protect and develop brand value is likely to involve grasping the nettle and proactively dealing with ‘welfare’ arrangements that could be deemed unethical, exploitative, unfair or anticompetitive. The drive for transparency on the issue could be a difficult one for both the corporate sector and the politicians to bear.

Besides sustainability, this is becoming the big corporate issue.

For the full story: see the Buzzflash article here, or the original LA Times article here.