London house prices are being driven beyond the Bank of England’s control by cash-rich foreign investors seeking top-end property in the capital.

Speaking on yesterday’s Andrew Marr show, Bank governor Mark Carney said the government’s Help to Buy scheme is having a minimal effect on the surging London market.

Instead, he said, the property surge is being driven by the continuing influx of foreign buyers whose cash purchases avoid the Bank’s influence, rendering it a spectator that can merely “watch” as prices rise.

Mr Carney said: “Much of what’s driven in London … is not mortgage-driven, it’s cash-driven. The top end of London is driven by cash buyers. It’s driven in many cases by foreign buyers.

“We, as a central bank, can’t influence that. We change underwriting standards, it doesn’t matter, it’s not a mortgage. We change interest rates, it doesn’t matter, it’s not a mortgage.”

However, Mr Carney went on to describe the surge in prices as an “adjustment” from their post-crash low, but which still remain below their 2008 peach. “They’ve now bounced back but they’re still more than 25% below historic averages, let alone stronger than historic averages,” he said.

His comments were at odds with figures released last week by Shelter, which suggested that the affordability of home-ownership is becoming an increasing problem.

Based on wage and house inflation figures collated from each area of the country since 1997, the homelessness charity claimed average earners would need to see their annual salaries double to match the rise in house prices.

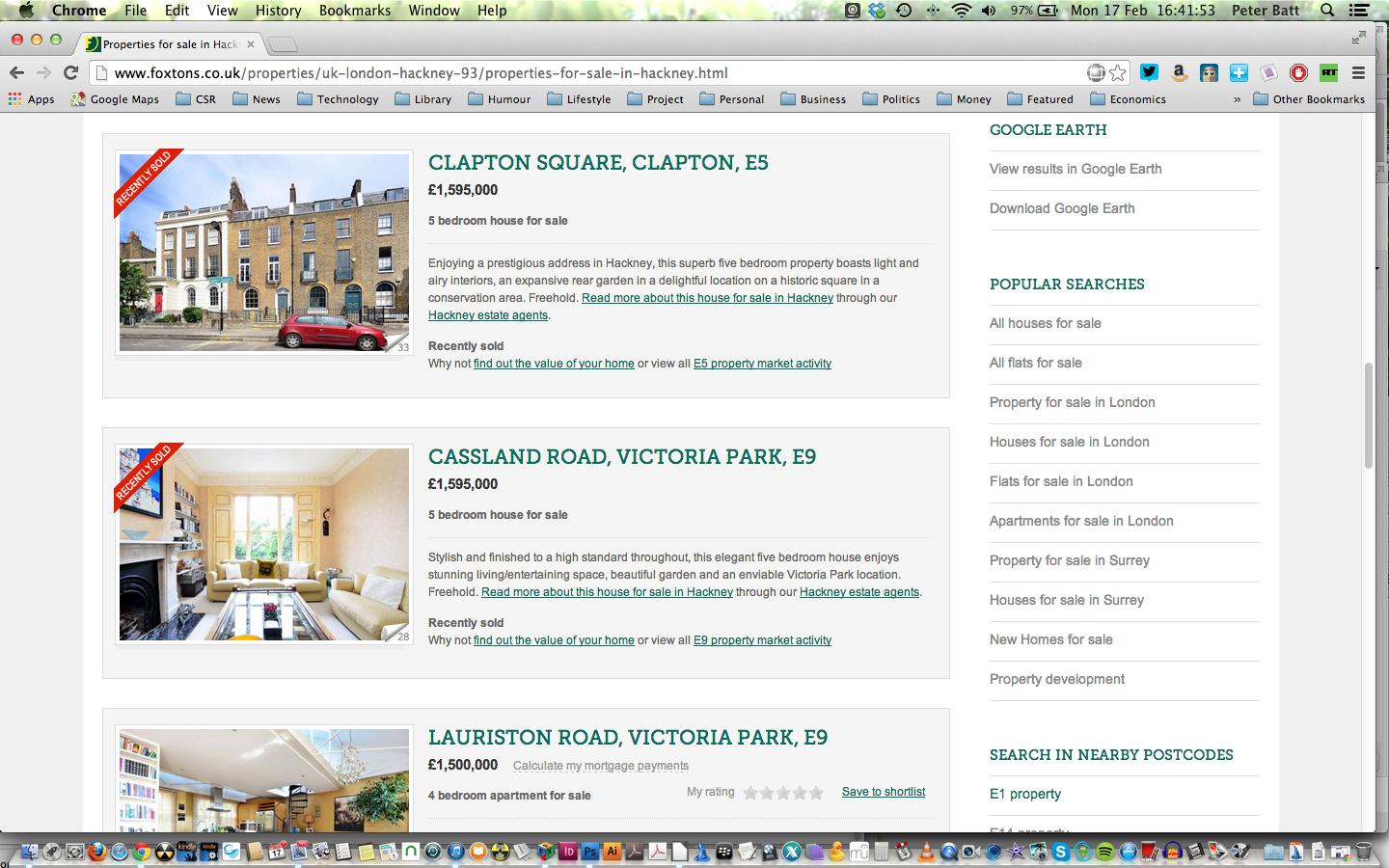

And it highlighted Hackney as an area where property values had become completely detached from wages, claiming that the average salary across the borough would need to rise by £100,000 to remain in line with the “astronomical increase” in local house prices.

The charity added: “Worryingly, there is not a single area in the whole country where wage and house price inflation have remained aligned. Burnley has the smallest gap, but here £10,000 would still need to be added to the average salary to put it in line with the rise in house prices.

“The impact of the housing shortage has been widespread, with the latest Census showing a drop in home ownership in England for the first time since records began.”

Shelter chief executive Campbell Robb added: “It is no surprise that the dream of a home of their own is slipping further out of reach for a generation.

“Politicians need to start meeting people halfway by committing to bold solutions that will get more affordable homes built. Otherwise future generations will find themselves priced out of a stable home, however hard they work or save.

“The only solution is to build more affordable homes.”